Will you get by with your state pension?

The answer is simple: no, you won’t.

At least, this is the case for most Belgians. Because your statutory pension is (considerably) lower than your final salary. In other words, it’s not enough to maintain your current lifestyle. That is why it’s a good idea to build up a supplementary pension. To close the gap and to safeguard your future comfort.

At NN we believe everyone is unique. And that everyone has their own way of preparing for their old age. How can you ensure a comfortable old age?

Ask yourself the following 3 questions

<small>1. When can I retire?</small>

The state retirement age is 65 and a full career spans 45 years. However, few people actually carry on that long: on average we retire at 61.

<small>2. How much statutory pension will I receive?</small>

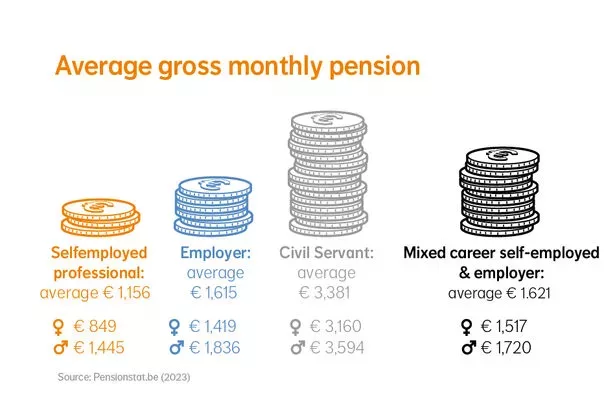

Every Belgian who works is entitled to a state pension. The amount you will receive each month depends on your statute, your career and your salary. This means it varies greatly from one person to the next. A guaranteed minimum pension has been determined for a full career. However, since most people don’t work the full 45 years, the actual average pension is lower.

<small>3. How much money will I need for my pension?</small>

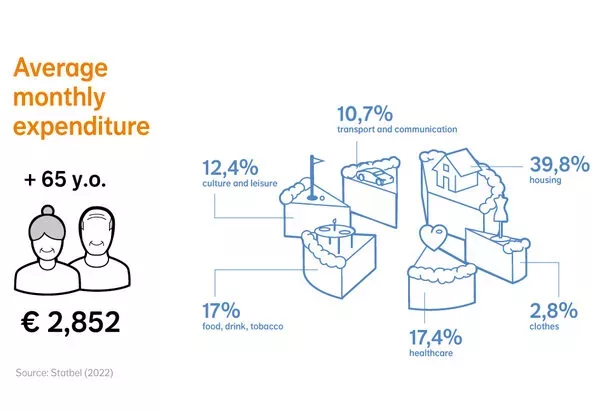

The average Belgian lives another 23 years after retirement. Fortunately your family expenditures drop once you’re retired: 10% on average. This means a single retiree spends approximately €1,733 per month. For a couple that’s €2,599. However, your income is cut by much more than 10%. For many Belgians, their state pension amounts to less than half their final salary.

Simulate how much you will need on top of your state pension

Curious to find out how much you will need to be safe in your old age? Your personal data is not stored.

Calculate your pension

Contact an NN insurance broker for more details or to schedule an appointment. He will be happy to discuss with you how you can make the most of your pension.

Pension solutions for you

I am a private individual

There is a choice of different formulas to close the gap between your final salary and your pension.

- With tax benefits

- Without a mortgage

- On top of your tax advantage

I am self-employed

Exactly which fiscal and financial benefits your supplementary pension will bring depends on your situation.

- The basic formula

- With a company

- Without a company

I am a private individual

Interested in tax-beneficial pension saving?

You can save for your retirement from just €40 per month, with a tax advantage up to 30%.

No (more) mortgage?

Long-term fiscal savings are interesting for you. Without a mortgage you benefit from 30% tax relief.

You’ve maximised your tax advantage and would like to save even more?

Save at your own pace with an insurance coupled with investment funds. Your potential return is higher and your funds remain available to you.

Are you over 50 and almost or already retired?

The capital of a group insurance policy, an optional supplementary pension plan for the self-employed (PLCI-VAPZ), an inheritance, pension savings or other savings can easily be converted into a fixed income with lifelong guaranteed annuity.

Extra investments with additional guarantees?

Investing with additional protection against the financial consequences in the event of incapacity for work and optional death insurance.

Are you self-employed?

The basis for every self-employed professional

With a Private Supplementary Pension for the Self-Employed (PSPSE) you can save up a tidy sum. At the same time you also benefit from social and tax advantages: up to 60% of your premium.

Self-employed professional with a company?

With your Individual Pension Commitment (IPA) you save a fixed monthly amount through your company. This is more tax-efficient than a pay rise or dividend! And since this is a dynamic investment your potential return is also higher.

Self-employed professional without a company?

With your Pension Commitment for the Self-Employed (POZ) you are entitled to 30% tax relief on what you save. Without a company, via your income tax. It’s a dynamic investment so there’s a higher potential return.

Group insurance for company directors

With Scala Executive you can build up a substantial supplementary pension and arrange income protection. The ideal solution if your business has multiple self-employed company directors.

Optimise your pension with our insurance broker

Your NN insurance broker listens to you, maps out your situation and elaborates a solution tailored to your needs. Thus you will discover the optimal way of financing your pension.